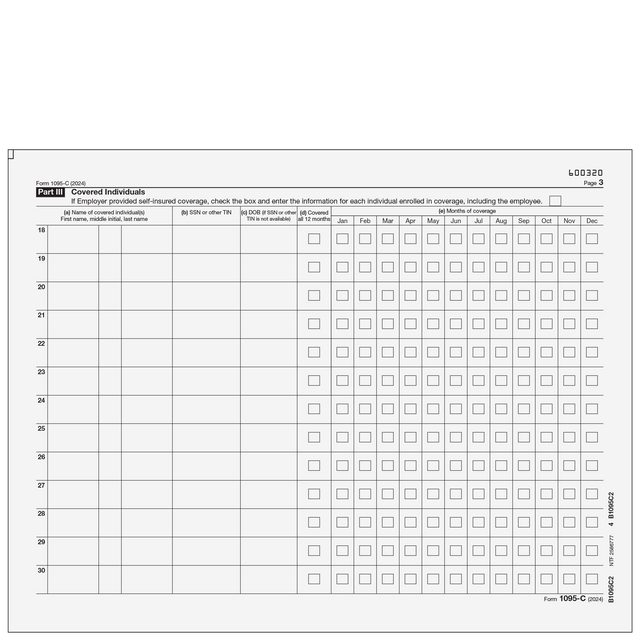

1095-C - Employer Provided Health Insurance Offer and Coverage (Covered Individuals) Page 2

Creative Document Solutions, LLC

Form 1095-C, Part III - Covered Individuals. Use this form in addition to item B1095C05 when reporting covered individuals.

IRS Section 6056 defines the reporting requirements for large employers (50 or more full-time equivalent employees) to provide their employees with documentation outlining any applicable offer of health coverage. Form 1095-C is a statement issued by employers with 50 or more full time employees (including FTEs) to employees and the IRS. Form 1094-C is the related transmittal sent to the IRS.

Quick Tip: If filing electronically: order one form per employee. If filing by paper: order one form for submission to the IRS and one form per employee.

(Approved 2025 version coming soon)

Please contact us for other quantities needed.